Stacks Futures & Perpetual Guide: Trade STX Futures On Delta Exchange

Understand what STX futures are and how to use the leverage in futures to amplify your trading gains

STX Contracts Listed on Delta Exchange

Stacks futures enable you to take long (you profit when market goes up) and short positions (you profit when market goes down) on STX. Futures have in-built leverage which acts as a multiplier to your returns. Currently, the following Stacks contracts are listed on Delta Exchange.

STX Futures Contract Details

| Contract Name | STXUSD |

|---|---|

| Description | Stacks Perpetual |

| Max. Leverage | 20x |

| Margin Currency | USD |

| Taker Fees | 0.05% |

| Maker Fees | 0.02% |

| Contract Type | perpetual futures |

What is Stacks Futures Trading?

Stacks Futures is an agreement between two parties to buy or sell Stacks at a predetermined future date and price. The futures contract derives its value from the underlying cryptocurrency, Stacks in this case. Thus the price of a Stacks futures contract moves broadly in sync with the price of Stacks.

Trading futures is thus an alternative to actually buying or selling the underlying crypto (aka spot trading). In spot trading, you can make profit by buying Stacks low and selling it at a high price. This trade however works only in a bull market, i.e. when Stacks price is going up. However, in a bear market, there is no trade possible in spot trading. Furthermore, leverage trading is not possible in spot trading.

Trading Stacks through futures offers several advantages over spot trading of Stacks, namely ability to both long or short and get access to leverage.

Trade profitably in all market conditions

You can profit from rising STX price by going long Stacks futures. And, when STX price is falling, you can make profits by going short. This feature of futures trading enable you to navigate all types of market conditions profitably. Compare this with directly buying Stacks. When price is falling, you can either sell your Stacks or suffer losses. In spot trading, there is no way of profiting from falling prices.

Hedge Price Risk

If you are a HODLer, you can still use futures to mitigate price risk. Say, you hold STX. You can mitigate the risks you face when Stacks is falling by going short STX futures. In this case, a short futures position acts as a downside protection by effectively locking the $ value of your portfolio without the need for selling your Stacks. Judicious use of futures as hedge can make you a better and stronger HODLer.

Amplify trading gains with leverage

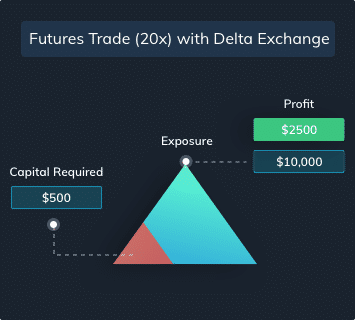

Leverage enables you to open positions that are bigger than your trading capital. If you can open a position that is 10 times bigger than your trading capital, then you have 10x leverage available to you. The maximum allowed leverage for futures listed on Delta Exchange is as high as 100x. There are two ways of thinking about leverage:

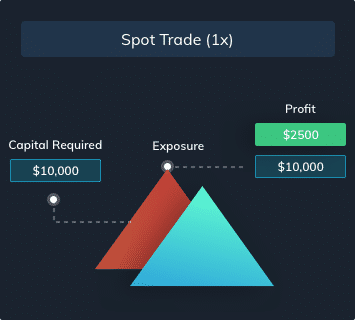

Leverage as capital efficiency driver: For opening a position of a given size, higher the leverage lower the trading capital required. The leverage in spot trading is always 1x, while it is 3-4x in margin trading. This means futures is 20 to 100 times more capital efficient than spot or margin trading.

Leverage as a returns amplifier: Because in a leverage trade position size is greater than the capital deployed, impact of prices moves gets magnified. The return on capital deployed is leverage times the price return. This means that you can amplify your trading gains the effective use of leverage.

If STX increased from $0 to $0 your return would be equal to:

Benefits of Trading STX Through Futures

Magnify returns through leverage

In-built leverage magnifies impact of STX price moves on your return on capital.

Trading both rising & falling markets

Long when bullish. Short when bearish. Trade all market conditions profitably.

Trade more with less

Deploy the capital freed up by using leverage in other trading opportunities

Why Trade STX Futures on Delta Exchange

Increase profitability

Low trading fees, tight spreads & deep order books of our STX contracts increase profitability of your trades

Improve risk management

Set TP / SL with your order, Leverage advanced order types and instruments (Options, Interest Rate Swaps) to create hedging strategies

Identify better trades

Use professional charts & advanced analysis tools to quickly identify trading opportunities

Have a Question About Trading STX Futures?

Why Delta Exchange?

Register Now Competitive spreads & fees

Competitive spreads & fees Generous Rewards

Generous Rewards 24/7 Support

24/7 Support